1

Please refer to important disclosures at the end of this report

1

1

Angel Top Picks – June 2020

Worst of Covid-19 crisis seem to be behind for developed economies –– Rapid

spread of Covid – 19 globally had led to Governments resorting to unprecedented

measures including nationwide shutdowns across the world including Europe,

while the US issued strict social distancing guidelines. The global lockdowns have

clearly slowed the spread of the Covid – 19 especially in countries which had been

impacted early on. New additions in Europe have slowed down significantly and

they have already opened up significant parts of their economy. While the US has

been the worst effected country with almost 2mn confirmed cases, the peak of

crisis seem to be behind them and all states have begun reopening their economy.

Monetary and fiscal stimulus by major economies leading to global equity rally –

Central banks and Governments globally have responded with unprecedented

monetary and fiscal stimulus in the aftermath of Covid - 19 in order to contain the

economic damage. The US Fed has pumped in record USD 2.9tn into the

economy through its quantitative easing program since March while most

Governments globally have announced large fiscal packages. As a result there has

been a surge in liquidity leading to a global risk on rally.

Unlock 1.0 and Government stimulus package to drive economic recovery - The

Ministry for Home Affairs (MHA) had announced significant relaxations in

restrictions on the 30th of May 2020. As a result we expect that restrictions will be

lifted in most parts of the country which should lead to increased economic activity

from June onwards. We believe that unlock 1.0 along with the stimulus package

announced by the Government earlier will help the economic recovery to gather

steam from here on.

Cyclical sectors to outperform in near term driven by positive FPI flows – Post the

sharp rally in April Indian markets witnessed a correction in May despite positive

inflows of `14,569 cr. as compared to outflows of `6,884 cr. in the previous

month. Given the US fed fuelled liquidity driven global rally we expect FPI flows to

remain strong which will drive out performance of Indian equities in the near term.

We expect the rally will be more broad based and cyclical sectors like Auto,

banking, construction, consumer goods to outperform in the near term given

beaten down valuations.

Increase in new Covid – 19 cases is key risk for Indian equities going forward -

There has been a mass movement of migrant workers from urban to rural areas

over the past few weeks which is leading to an increase in new cases. Though

India has managed to contain the virus so far by enforcing one of the strictest

lockdown globally, there is a possibility of a jump in new cases down the line given

increased movement of people. In that case the economic recovery may get

pushed back as the Government could be forced to roll back some of the

relaxations. This may result in increased market volatility down the line especially

in cyclical sectors which are leading the current leg of the rally.

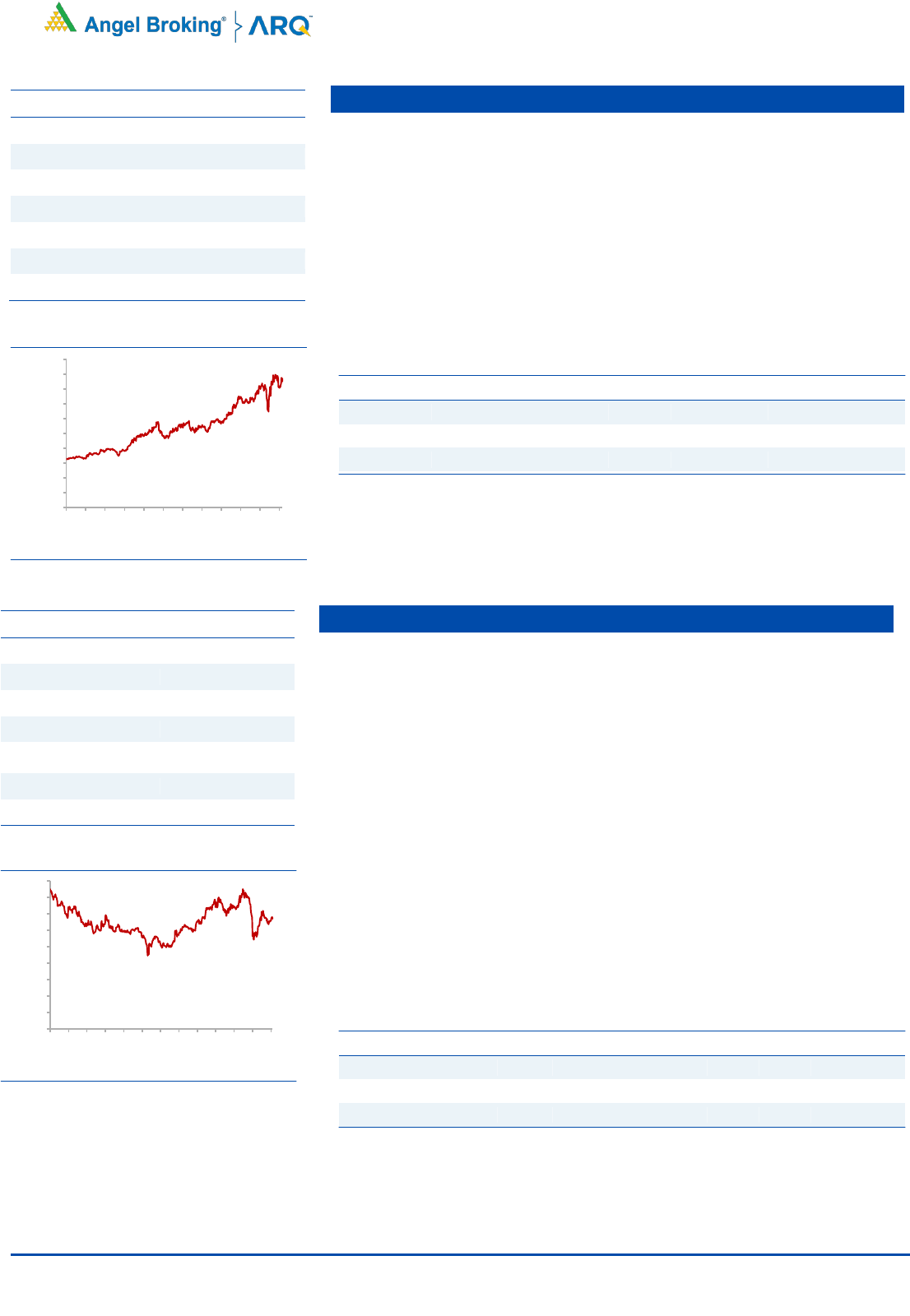

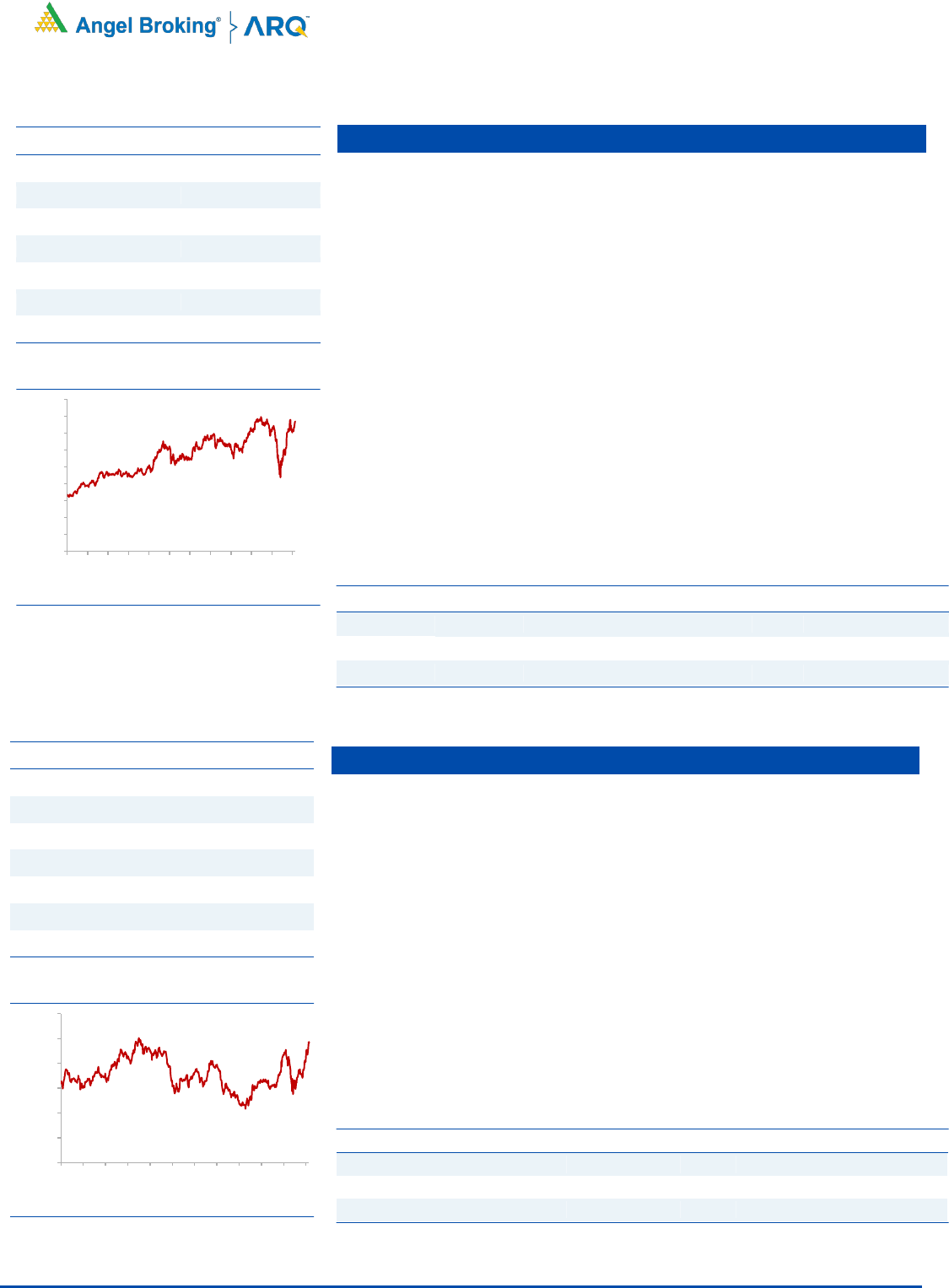

Top Picks Performance

Return Since Inception (30th Oct, 2015)

Top Picks Return

44.0%

BSE 100

23.0%

Outperformance

21.0%

Source: Company, Angel Research (as on 2

nd

June, 2020)

Top Picks

Company

CMP (`)

TP (`)

FMCG

Colgate-Palmolive

1,364

1,620

Nestle India

17,020

20,687

P&G Hygiene

10,032

12,230

Britannia Industries

3,450

3,780

Hindustan Unilever

2,107

2,364

Other Consumer Goods

Avenue Supermarts

2,381

2,735

Banking/NBFC

HDFC Ltd

1,815

2,000

ICICI Bank

348

410

Axis Bank

410

500

Bajaj Finance

2,346

3,000

Pharma

IPCA Laboratories

1,555

1,900

Dr Reddy’s Lab

3,896

4,570

IT

Infosys

708

841

L&T Infotech

1,852

2,145

Chemicals/Agrochemicals

PI Industries

1,557

1,785

Galaxy Surfactants

1,360

1,610

Aarti Industries

974

1,284

Telecom/Others

Bharti Airtel

558

672

Reliance Industries

1,536

1,748

Larsen & Toubro

945

1,093

Auto

Escorts

958

1,150

Source: Company, Angel Research

Note: Closing price as on 2nd June,2020

2

Error!

Refer

ence

sourc

Angel Top Picks | June 2020

June 5, 2020

2

Top Picks

3

Error!

Refer

ence

sourc

Angel Top Picks | June 2020

June 5, 2020

3

Avenue Supermarts

Avenue Supermarts owns and operates the supermarket chain ‘D-MART’.

Focused on value retailing, it offers a wide range of fast-moving consumer

(food and non-food) products, general merchandise and apparel.

Currently, the company has 196 D-MART stores and it expects to open 30

stores every year through its cluster approach.

DMART offers significant discount compared to e-commerce, Modern trade

(~6%) and General trade (~18%), which would drive revenue growth.

Operating margin is higher compared to its peers due to the company’s low

cost structure.

We expect DMART to report consolidated revenue/PAT CAGR of 19s%/26%,

respectively over FY2019-22E.

Key Financials

Y/E

Sales

OPM

PAT

EPS

ROE

P/E

P/BV

EV/Sales

March

(` cr)

(%)

(` cr)

(`)

(%)

(x)

(x)

(x)

FY2021E

27781

8.4

1419

21.9

17.1

107.4

18.3

5.5

FY2022E

33730

8.8

1825

28.2

18.0

83.5

15.0

4.5

Source: Company, Angel Research

Dr Reddy’s Lab

Dr Reddy’s has a very strong product portfolio with 55%-65% of its revenue

coming from its chronic which is a high growth segment and will be least

impacted due to lockdown globally.

The company has a very healthy US pipeline with 99 ANDA’s pending

approval from the US FDA including 30 FTF’s. The company intends to launch

25 new products FY21.

DRL has incurred large capex over last 5 years with net block increasing from

INR 5380cr in 2015 to INR 9300cr in 2020. With current capacity utilization at

50% we do not envisage any significant capex for the company going forward.

DRL has acquired domestic business of Wockhardt pharma for 800cr in an all

cash deal, which is expected to complete in Q1FY21. DRL will get 62 brands

with total annual sales of 1830cr which we believe is value accretive for the

company

Key Financials

Y/E

Sales

OPM

PAT

EPS

ROE

P/E

P/BV

EV/Sales

March

(` cr)

(%)

(` cr)

(`)

(%)

(x)

(x)

(x)

FY2021E

18840

23.5

2705

166.6

30.5

23.4

4.1

3.4

FY2022E

20855

25

3137

192.6

32

20

3.8

3.1

Source: Company, Angel Research

Stock Info

CMP

2,381

TP

2,735

Upside

14.9%

Sector

Retail

Market Cap (` cr)

154,244

Beta

0.7

52 Week High / Low

2,559/1,284

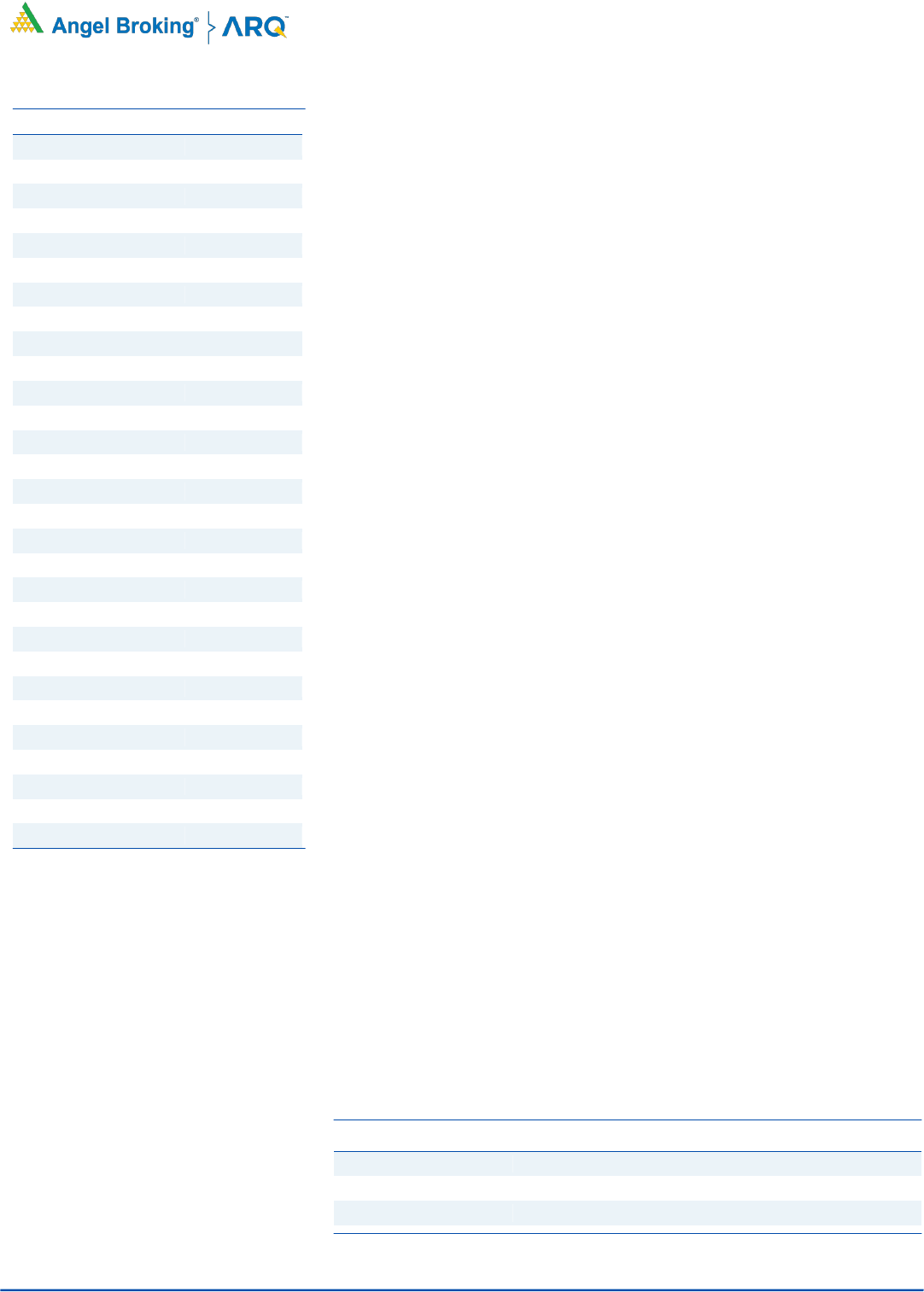

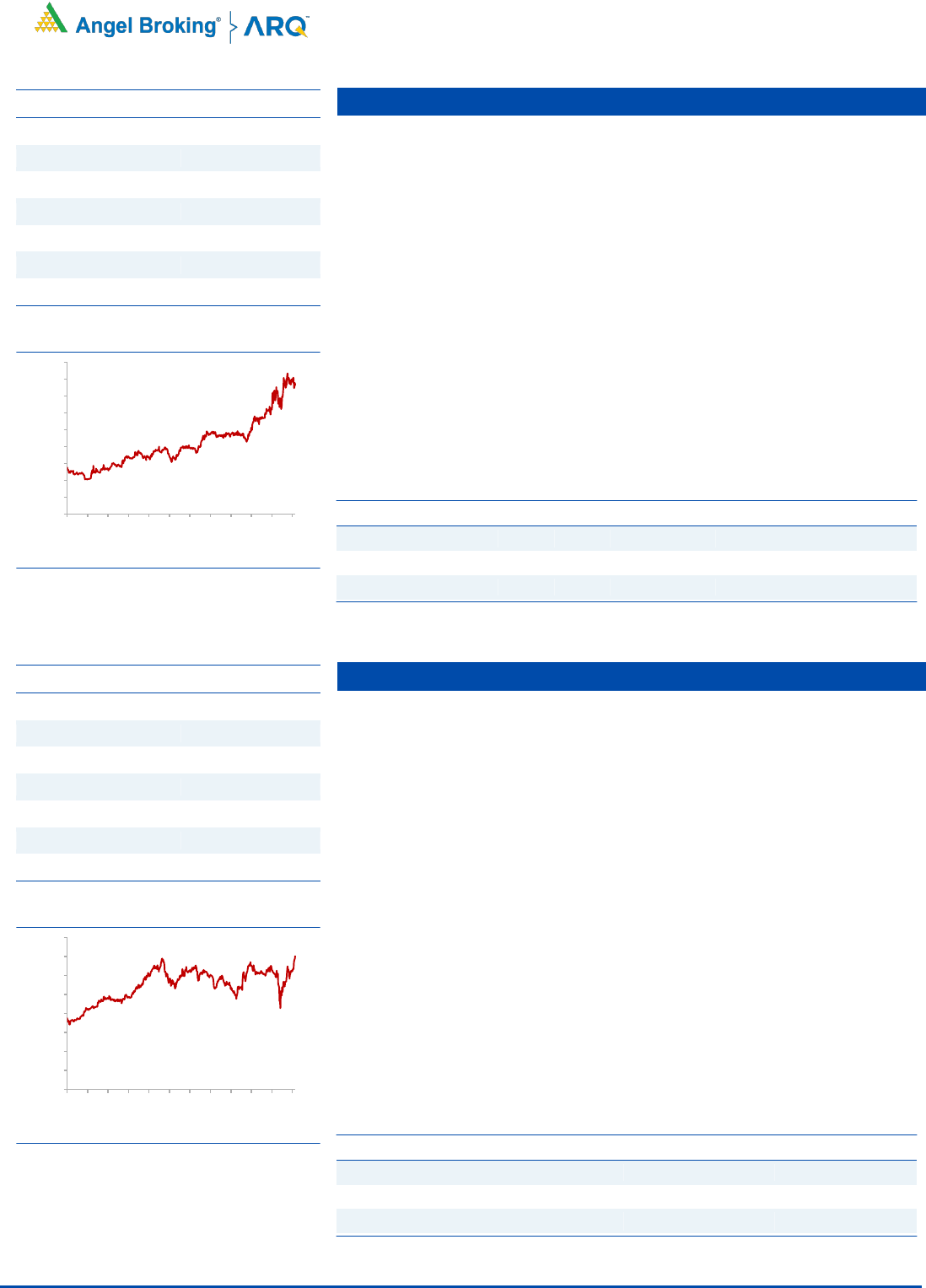

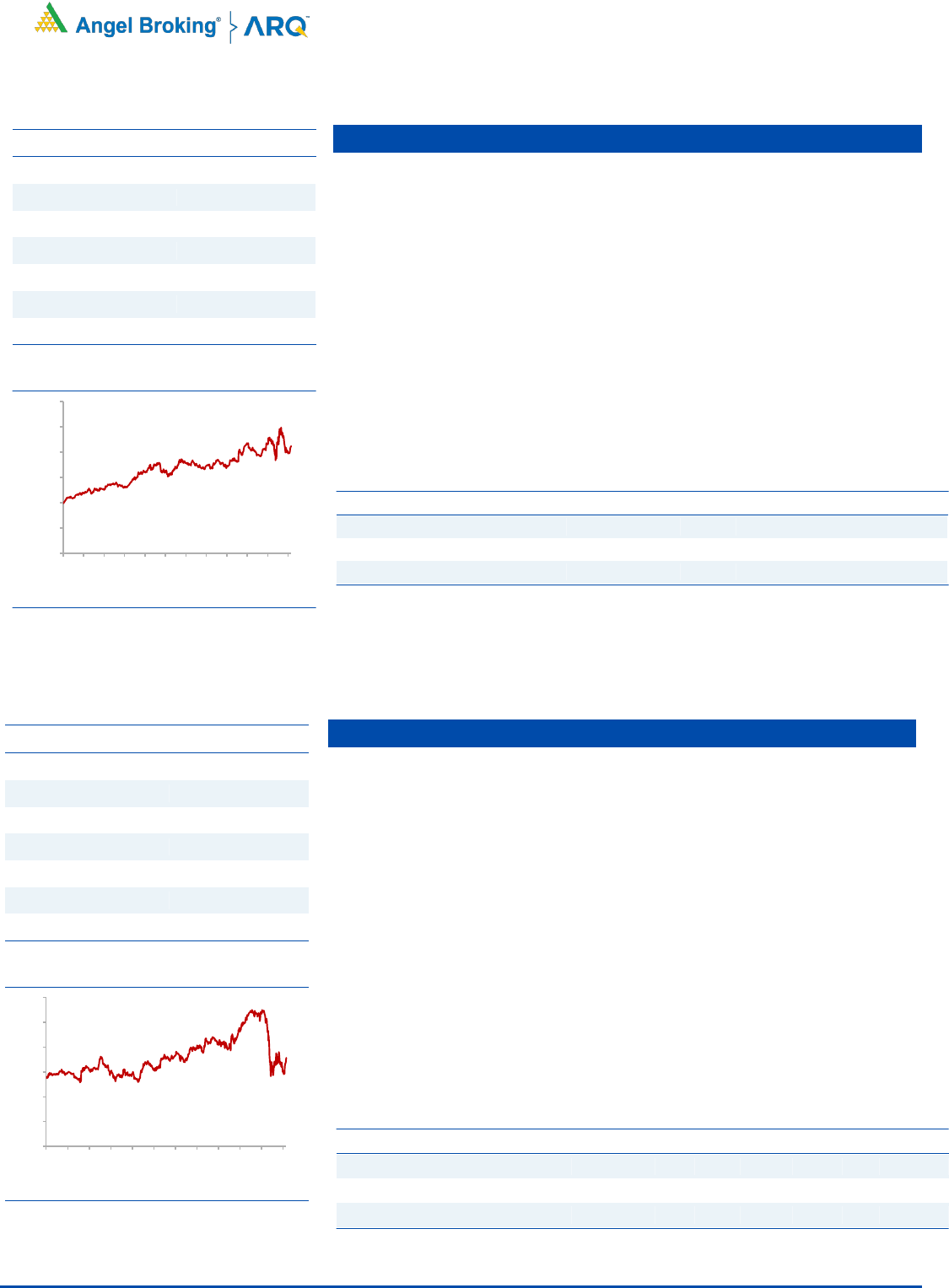

3 year-Chart

Source: Company, Angel Research

-

500

1,000

1,500

2,000

2,500

3,000

May-17

Aug-17

Dec-17

Mar-18

Jun-18

Sep-18

Jan-19

Apr-19

Jul-19

Nov-19

Feb-20

May-20

Stock Info

CMP

3,896

TP

4,570

Upside

17.3%

Sector

Pharma

Market Cap (` cr)

64,755

Beta

0.5

52 Week High / Low

4,099/2,352

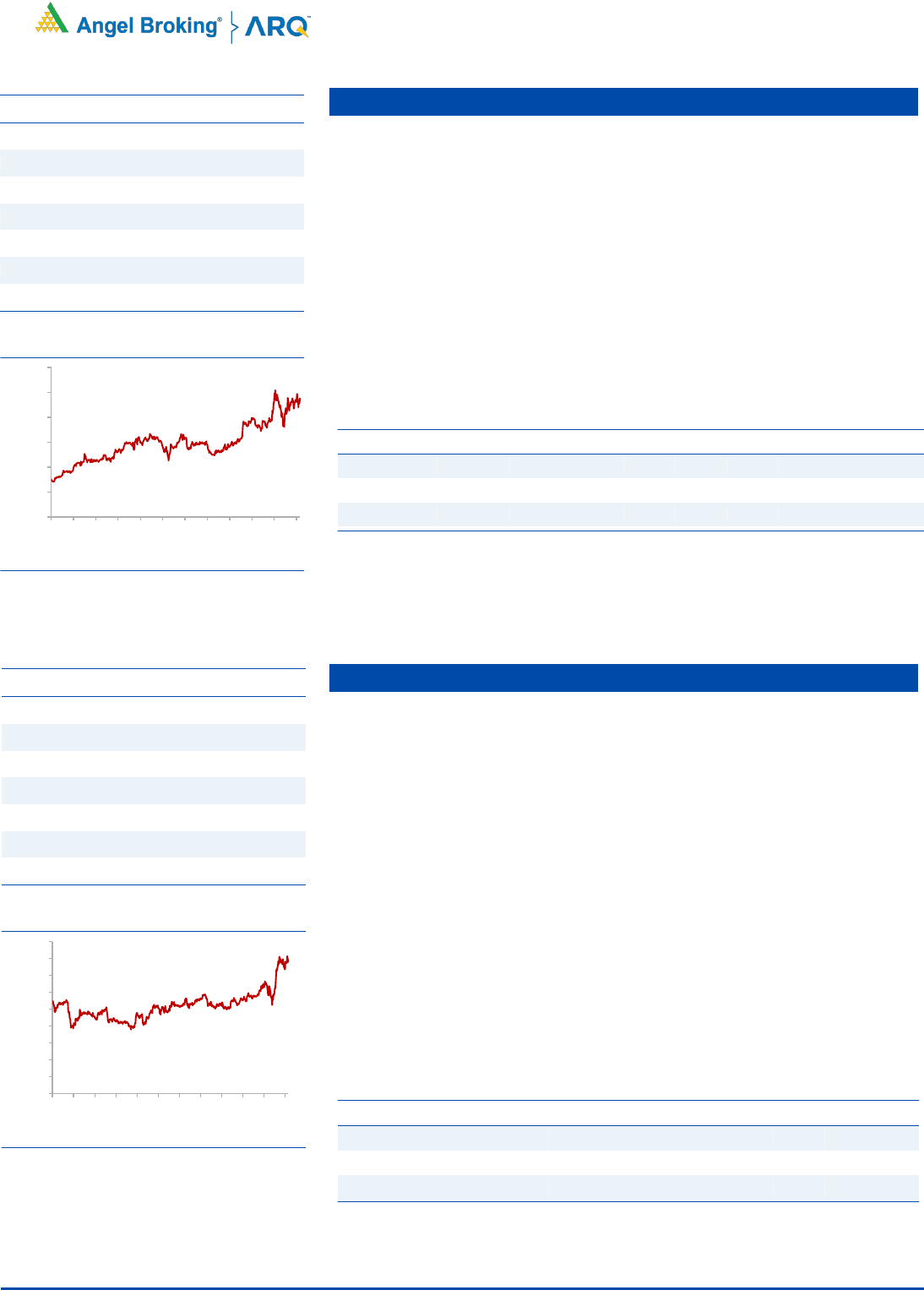

3 year-Chart

Source: Company, Angel Research

-

500

1,000

1,500

2,000

2,500

3,000

3,500

4,000

4,500

May-17

Aug-17

Dec-17

Mar-18

Jun-18

Sep-18

Jan-19

Apr-19

Jul-19

Nov-19

Feb-20

May-20

4

Error!

Refer

ence

sourc

Angel Top Picks | June 2020

June 5, 2020

4

Bharti Airtel

There is going to be some impact on subscribers from the low income group

especially daily wage earners due to the lockdown. However a sharp increase

in data consumption should make up for a significant portion of the loss.

Therefore we expect limited impact on Bharti from the lockdown.

Bharti has raised capital of USD 2bn from a QIP at `445 per share along with

FCCB issues of USD 1bn in January 2020. Therefore Bharti is much better

placed as compared to Vodafone Idea in terms of liquidity.

Telecom operators have increased tariffs by ~35% in Nov’19. There is a

possibility of another round of tariff hikes by telecom companies in FY21 given

that tariffs are still very low. If this were to happen then it would lead to further

upsides to our estimates for FY21 and FY22.

Even if there is no major tariff hike in FY21 and Vodafone Idea goes out of

business, Bharti would benefit significantly from addition of subscribers.

Key Financials

Y/E

Sales

OPM

PAT

EPS

ROE

P/E

P/BV

EV/Sales

March

(` cr)

(%)

(` cr)

(`)

(%)

(x)

(x)

(x)

FY2021E

101322

43.1

4046

5.5

3.6

101.8

3.7

3.7

FY2022E

114360

44.4

8056

12.5

7.7

44.7

3.4

3.1

Source: Company, Angel Research

Larsen & Toubro

L&T is India’s largest EPC Company with a strong presence across various

verticals including Infra, Hydrocarbon and services segment. The company

also has a very strong presence in the IT services and NBFC space through its

various subsidiary companies which are also growth drivers for the company.

The company has a strong order backlog of ~INR 3lakh cr. Majority of the

order book is from the central government, state government and PSU, where

risk of cancellation is low.

On the macro front it seems that the covid 19 situation is well under control in

Europe, while the worst of the outbreak seems to be behind for the US which is

leading to a risk on rally globally. We therefore feel that while there will be

near term challenges for the company in terms of order flow and execution,

the stock is trading at significant discount to historical average valuations and

offers favorable risk reward from current levels given global tailwinds.

Key Financials

Y/E

Sales

OPM

PAT

EPS

ROE

P/E

P/BV

EV/Sales

March

(` cr)

(%)

(` cr)

(`)

(x)

(%)

(%)

(x)

FY2021E

62140

6.1

3589

24.8

5.8

38.1

1.9

2.8

FY2022E

85369

9.7

7605

54.2

10.8

17.4

1.8

2.0

Source: Company, Angel Research (Above are standalone numbers)

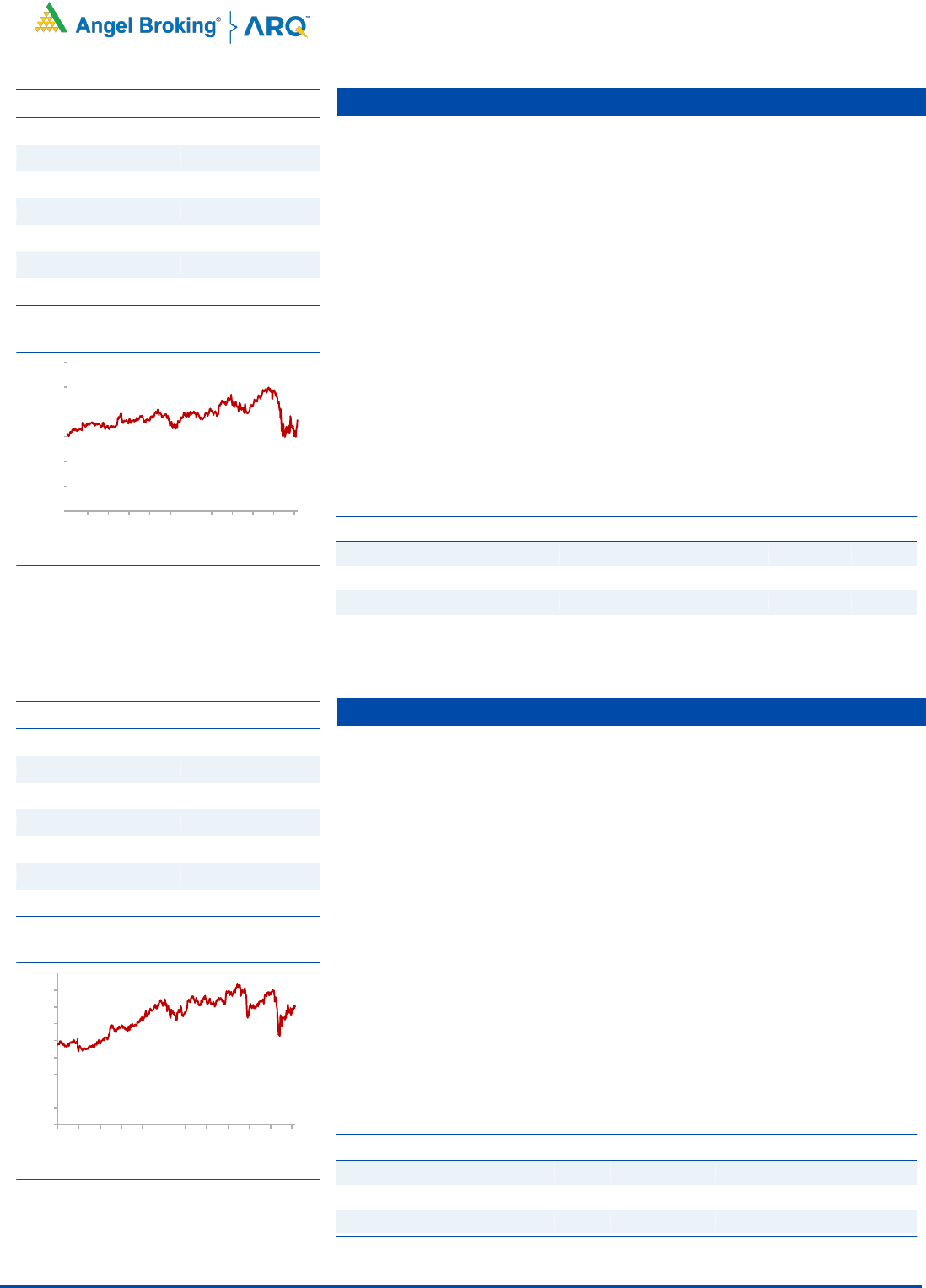

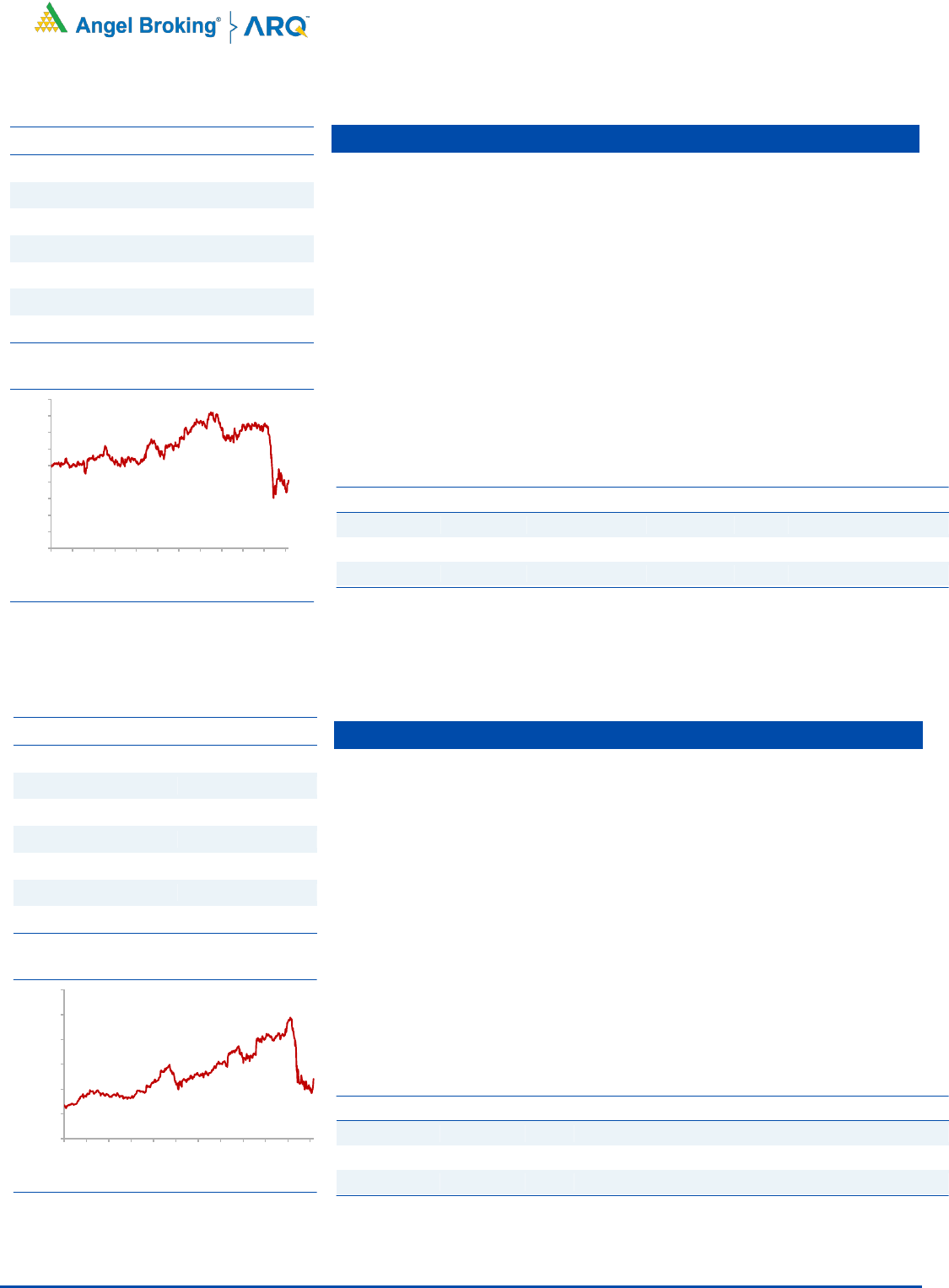

Stock Info

CMP

945

TP

1,093

Upside

15.7%

Sector

Infrastructure

Market Cap (` cr)

132,723

Beta

1.1

52 Week High / Low

1,591/661

3 year-Chart

Source: Company, Angel Research

-

200

400

600

800

1,000

1,200

1,400

1,600

1,800

May-17

Aug-17

Dec-17

Mar-18

Jun-18

Sep-18

Jan-19

Apr-19

Jul-19

Nov-19

Feb-20

May-20

Stock Info

CMP

558

TP

672

Upside

20.4%

Sector

Telecom

Market Cap (` cr)

304,420

Beta

0.8

52 Week High / Low

611/321

3 year-Chart

Source: Company, Angel Research

-

100

200

300

400

500

600

700

May-17

Aug-17

Dec-17

Mar-18

Jun-18

Sep-18

Jan-19

Apr-19

Jul-19

Nov-19

Feb-20

May-20

5

Error!

Refer

ence

sourc

Angel Top Picks | June 2020

June 5, 2020

5

PI Industries Ltd.

PI Industries is a leading player in providing Custom synthesis and

manufacturing solutions (CSM) to global agrochemical players. The CSM

business accounted for 66% of the company’s revenues in FY19 and is

expected to be the key growth driver for the company in future

The company has been increasing its share of high margin CSM business

driven by strong relationship with global agrochemical players. PI is leveraging

its chemistry skill sets and is looking to diversify its CSM portfolio to electronic

chemicals, Pharma API, fluoro chemicals, etc. which will help drive business.

Though the company’s operations have been impacted due to the Covid-19

outbreak we expect that PI Industries would be amongst the least impacted in

the sector given that the company is a pure play agrochemical player which

are part of essential commodities.

Key Financials:

Y/E

Sales

OPM

PAT

EPS

ROE

P/E

P/BV

EV/Sales

March

(` cr)

(%)

(` cr)

(`)

(%)

(x)

(x)

(x)

FY2021E

3,877

21.5

555

40.2

17.4

38.7

3.4

5.4

FY2022E

4,992

22.5

770

55.8

20.0

27.9

2.8

4.2

Source: Company, Angel Research

Colgate-Palmolive (India)

Colgate-Palmolive India Ltd (CPIL) is engaged in manufacturing & selling of

oral care products such as toothpastes and toothbrushes.

CPIL has leadership position in both toothpastes (52% market share) and

toothbrushes (45% market share).

CPIL continuously invests on ad-spends to strengthen the Colgate brand.

Colgate is India’s No. 1 Most Trusted Oral Care Brand.

CPIL has increased its distribution 2.3x over the last 6-7 years and is

continuously making efforts to deepen its penetration.

We believe that CPIL should ultimately be able to see sharper market share

gain in toothpastes segment on the back of higher ad-spend and re-launch of

Colgate Strong Teeth (decent traction seen in last quarter).

Key Financials

Y/E

Sales

OPM

PAT

EPS

ROE

P/E

P/BV

EV/Sales

March

(` cr)

(%)

(` cr)

(`)

(%)

(x)

(x)

(x)

FY2021E

4566

26.6

786

28.9

37.6

47.3

17.8

8.0

FY2022E

4931

27.9

900

33.1

36.8

41.3

15.2

7.4

Source: Company, Angel Research

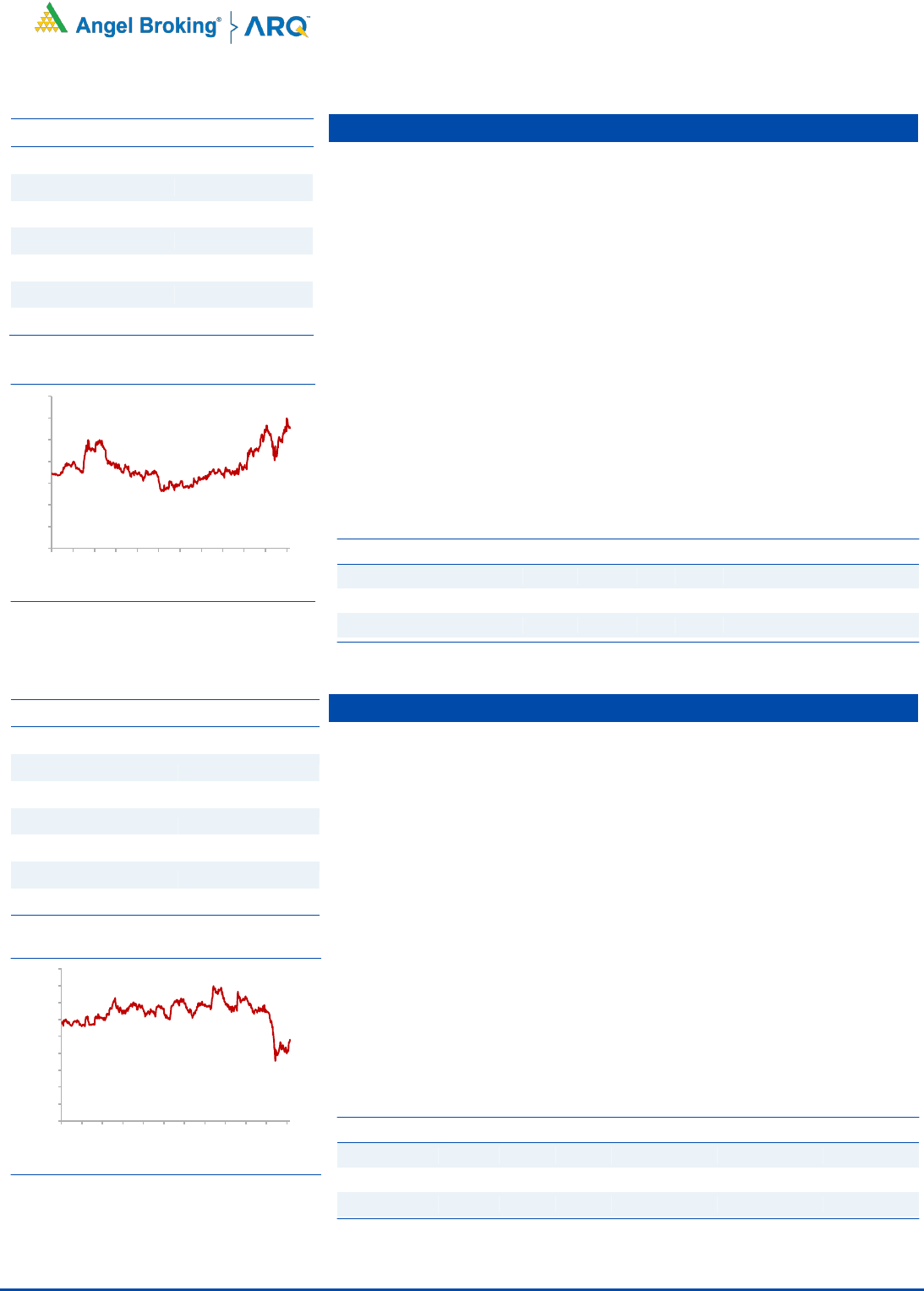

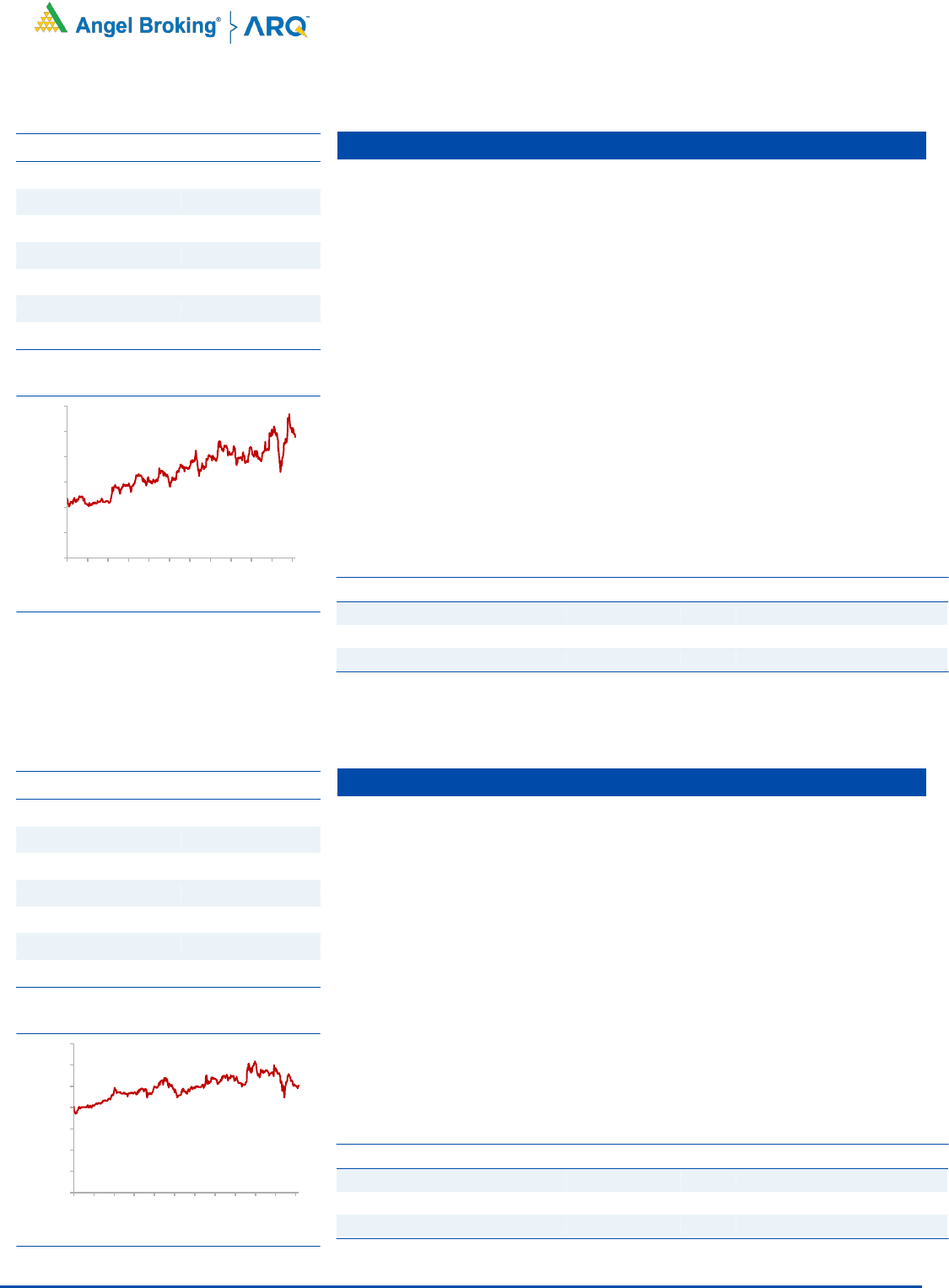

Stock Info

CMP

1,365

TP

1,620

Upside

18.6%

Sector

FMCG

Market Cap (` cr)

37,120

Beta

0.5

52 Week High / Low

1,641/1,065

3 year-Chart

Source: Company, Angel Research

-

200

400

600

800

1,000

1,200

1,400

1,600

1,800

May-17

Aug-17

Dec-17

Mar-18

Jun-18

Sep-18

Jan-19

Apr-19

Jul-19

Nov-19

Feb-20

May-20

Stock Info

CMP

1,557

TP

1,785

Upside

14.6%

Sector

Agro Chemicals

Market Cap (` cr)

21,525

Beta

0.7

52 Week High / Low

1,642/973

3 year-Chart

Source: Company, Angel Research

-

200

400

600

800

1,000

1,200

1,400

1,600

1,800

May-17

Aug-17

Dec-17

Mar-18

Jun-18

Sep-18

Jan-19

Apr-19

Jul-19

Nov-19

Feb-20

May-20

6

Error!

Refer

ence

sourc

Angel Top Picks | June 2020

June 5, 2020

6

Nestle (India)

Nestle India Ltd (Nestle) manufactures and sells a variety of food products

such as Milk & Nutrition, Prepared Dishes & Cooking Aids, Powdered & Liquid

Beverages and Confectionery.

Nestle enjoys market leadership position in ~85% of its Portfolio. Nestle has

wide distribution network (4.6mn outlets) across India and strong brand recall.

Strong balance sheet coupled with free cash flow and higher profitability.

Going forward, we expect healthy growth and profitability on the back of

strong brand, wide distribution network and new product launches.

Key Financials

Y/E

Sales

OPM

PAT

EPS

ROE

P/E

P/BV

EV/Sales

March

(` cr)

(%)

(` cr)

(`)

(x)

(%)

(%)

(x)

CY2020E

13235

22.7

2091

216.9

34.9

80.3

28.0

12.2

CY2021E

14558

23.3

2333

242.0

31.3

72.0

22.5

11.0

Source: Company, Angel Research

Galaxy Surfactants

Galaxy Surfactants is a market leader in oleo chemical-based surfactants,

which is used in personal and home care products including skin care, oral

care, hair care, cosmetics, toiletries and detergent products.

The company has been increasing its share of high margin specialty care

products in its portfolio which now accounts for ~ 40% of its revenues while

the balance is accounted for by the performance surfactant business.

Company has very strong relationship with MNC clients like Unilever, P&G,

Henkel, Colgate-Palmolive and supplies raw materials to them not only in

India but also in US, EU and MENA region.

Though the company’s operations have been impacted due to the Covid-19

outbreak we expect that Galaxy Surfactants would be amongst the least

impacted in the sector given the company’s exposure to the personal and

home care segment.

Key Financials

Y/E

Sales

OPM

PAT

EPS

ROE

P/E

P/BV

EV/Sales

March

(` cr)

(%)

(` cr)

(`)

(%)

(x)

(x)

(x)

FY2021E

2,672

14.0

221

62.2

0.2

21.7

4.0

1.8

FY2022E

2,886

14.3

223

62.8

0.2

19.4

3.5

1.7

Source: Company, Angel Research

Stock Info

CMP

1,360

TP

1,610

Upside

18.4%

Sector

Chemicals

Market Cap (` cr)

4,823

Beta

0.6

52 Week High / Low

1,790/975

3 year-Chart

Source: Company, Angel Research

-

200

400

600

800

1,000

1,200

1,400

1,600

1,800

Feb-18

Apr-18

Jun-18

Sep-18

Nov-18

Jan-19

Apr-19

Jun-19

Aug-19

Oct-19

Jan-20

Mar-20

May-20

Stock Info

CMP

17,020

TP

20,687

Upside

21.5%

Sector

FMCG

Market Cap (` cr)

164,108

Beta

0.6

52 Week High / Low

18,301/11,270

3 year-Chart

Source: Company, Angel Research

-

2,000

4,000

6,000

8,000

10,000

12,000

14,000

16,000

18,000

20,000

May-17

Aug-17

Dec-17

Mar-18

Jun-18

Sep-18

Jan-19

Apr-19

Jul-19

Nov-19

Feb-20

May-20

7

Error!

Refer

ence

sourc

Angel Top Picks | June 2020

June 5, 2020

7

IPCA Laboratories

IPCA’s 54% of revenue comes from domestic generic and API business.

Generics and API continues to provide revenue growth for Ipca. Expected to

outperform the Indian Pharmaceutical market (IPM) by 8%-10% p.a in FY 22.

EU generic & branded which account for 15% of the company’s revenues are

on growth trajectory along with higher margins (40% EBITDA margins).

Current capacity utilization of plants which supply to Europe is at 20% which is

expected to ramp up from current levels. We expect the European business to

show 30-35% PAT growth.

Ipca manufacture over 350 formulations and 80 APIs for various therapeutic

segments like Pain management. Currently the company has 18 ANDA

sapprovals, 46 ANDA filled with authorities while 8 products are in clinical

trials.

Britannia Industries

Britannia Industries (BRIT)’s principal activity is manufacture and sale of

biscuits, bread, rusk, cakes and dairy products.

BRIT has brands like Tiger, Good-Day, and 50:50 under its fold with an

estimated market share of 33% in the Indian biscuits industry. Biscuits

contribute more than 80% of the company’s turnover.

BRIT has an overall distribution reach of 5.5 million outlets. With consistent

focus on distribution expansion, BRIT has narrowed the gap with the No. 1

player. The gap with largest distributed brand is now just 0.8 million outlets.

In Q4FY20 BRIT have outperformed other companies in FMCG space with

YOY growth of 2.5%/20bp/27% in Revenue/EBITDA/PAT respectively. Going

ahead in near term, food industry is witnessing a shift from dining out/ street

food to home consumption. BRIT being a low price product with trusted brands

is well positioned to cater the shift.

Stock info

CMP

1,555

TP

1,900

Upside

22.2%

Sector

Pharma

Market Cap (` cr)

19,655

Beta

0.3

52 Week High / Low

1,821/844

3 year-Chart

Source: Company, Angel Research

Key Financials

Y/E

Sales

OPM

PAT

EPS

ROE

P/E

P/BV

EV/Sales

March

(` cr)

(%)

(` cr)

(`)

(%)

(x)

(x)

(x)

FY2021E

5360

22.5

821

65.7

18.8

23.7

4.6

3.9

FY2022E

6111

23.0

976

78.1

18.6

19.9

3.9

3.4

Source: Company, Angel Research

Stock Info

CMP

3,450

TP

3,920

Upside

13.6%

Sector

FMCG

Market Cap (` cr)

82,968

Beta

0.9

52 Week High / Low

3,479/2,100

3 year-Chart

Source: Company, Angel Research

Key Financials

Y/E

Sales

OPM

PAT

EPS

ROE

P/E

P/BV

EV/Sales

March

(` cr)

(%)

(` cr)

(`)

(%)

(x)

(x)

(x)

FY2021E

13,142

15.7

1536.5

63.9

29.5

54

18.8

6.7

FY2022E

14,587

15.7

1713.7

71.3

28.6

48.4

15.6

6.0

Source: Company, Angel Research

-

200

400

600

800

1,000

1,200

1,400

1,600

1,800

May-17

Aug-17

Dec-17

Mar-18

Jun-18

Sep-18

Jan-19

Apr-19

Jul-19

Nov-19

Feb-20

May-20

-

500

1,000

1,500

2,000

2,500

3,000

3,500

4,000

May-17

Aug-17

Dec-17

Mar-18

Jun-18

Sep-18

Jan-19

Apr-19

Jul-19

Nov-19

Feb-20

May-20

8

Error!

Refer

ence

sourc

Angel Top Picks | June 2020

June 5, 2020

8

HDFC Ltd.

HDFC has sufficient capital (Tier-1 -16.6%) and Liquidity (Rs.30,000cr) to tide

over this situation.

HDFC’s superior know how of the segment; strict underwriting practices and

buffer provision would help it to better manage the credit loss

As per NHB norms, HDFC is required to carry total provision of Rs. 4,188

crore, against which actual provisions as of Q4FY2020 were at Rs. 10,988

crore, which is over and above regulatory requirement and provides investor

comfort.

HDFC is currently available at ~1.7x its FY2022E BV, which we believe is

reasonable considering its robust operating metrics, experience management,

Healthy provision and sustainable business model.

Infosys

Infosys is amongst the top three IT services company based out of India and

provides a vast gamut of services like ADM, Enterprise solutions, Infrastructure

management services etc.

Under the new management of Mr. Salil Parekh Infosys has become

aggressive in terms of signing new deals, which is expected to drive growth for

the company. New deal wins has clearly accelerated with the company

winning deals worth USD 6.3bn and USD 9.0bn in FY19 & FY20 respectively

as against deal wins of USD 3.1bn in FY18.

We expect the company to post revenue/EBITDA/PAT growth of

7.5%/3.7%/5.1% between FY19-FY22 despite Covid-19 outbreak affecting

FY21 numbers. Rupee depreciation from ~71 levels to ~76 to the US dollar

will have a positive impact on top line and bottom-line and will mitigate the

adverse impact due to Covid-19 outbreak to a large extent.

Stock Info

CMP

1,815

TP

2,000

Upside

10.2%

Sector

Banking

Market Cap (` cr)

314,323

Beta

1.3

52 Week High / Low

2,500/1,473

3 year-Chart

Source: Company, Angel Research

Key Financials

Y/E

Op. Inc

NIM

PAT

EPS

ABV

ROA

ROE

P/E

P/ABV

March

(` cr)

(%)

(` cr)

(`)

(`)

(%)

(%)

(x)

(x)

FY2021E

12,216

3.4

7,978

46

543

1.4

10

39

3.3

FY2022E

13,421

3.4

10,260

59

590

1.7

12

31

3.1

Source: Company, Angel Research

Stock Info

CMP

708

TP

841

Upside

18.8%

Sector

IT

Market Cap (` cr)

301,566

Beta

0.8

52 Week High / Low

847/511

3 year-Chart

Source: Company, Angel Research

Key Financials

Y/E

Sales

OPM

PAT

EPS

ROE

P/E

P/BV

EV/Sales

March

(` cr)

(%)

(` cr)

(`)

(%)

(x)

(x)

(x)

FY2021E

90,650

21.3

16,200

38.2

28.1

18.3

5.0

2.8

FY2022E

1,02,857

20.5

17,870

42.1

30.5

16.6

4.7

2.5

Source: Company, Angel Research

-

500

1,000

1,500

2,000

2,500

3,000

May-17

Aug-17

Dec-17

Mar-18

Jun-18

Sep-18

Jan-19

Apr-19

Jul-19

Nov-19

Feb-20

May-20

-

100

200

300

400

500

600

700

800

900

May-17

Aug-17

Dec-17

Mar-18

Jun-18

Sep-18

Jan-19

Apr-19

Jul-19

Nov-19

Feb-20

May-20

9

Error!

Refer

ence

sourc

Angel Top Picks | June 2020

June 5, 2020

9

Aarti Industries

Aarti Industries is the lowest cost producer in Benzene based derivatives.

Company accounts for 20% of world’s Nitrochloro Benzene (NCB) and 10% of

dichloride benzene (DCB) capacity.

Company has been constantly increasing its share of high margin downstream

products which now accounts for 70% of the company’s revenues. Company is

expanding its NCB capacity which would be utilized for manufacture of high

margins downstream products.

Company is well diversified across product, customer, geography and end

user industry and is not likely to be impacted too much from the Covid-19

outbreak. Exports account for 40% of revenues while balance 60% is from

domestic sales. Significant opportunity for company arising from

environmental related issues in China and companies looking to diversify

supply chains.

P&G Hygiene & Healthcare Ltd.

P&GHH manufactures, distributes and markets three major brands in India –

Whisper (sanitary napkins), Vicks (balm, cough drops and tablets), and Old

Spice (aftershave lotion and deodorants).

Whisper being market leader with market share of 56% in Sanitary pad

segment contributes ~69% of total revenue. Sanitary Pads having less than

20% market penetration leaves immense growth opportunity for Whisper. icks

beings market leader with market share of ~30% contributes 30% of Total

Revenue.

Going forward, we expect healthy growth and profitability on the back of

strong brand, wide distribution network and new product launches.

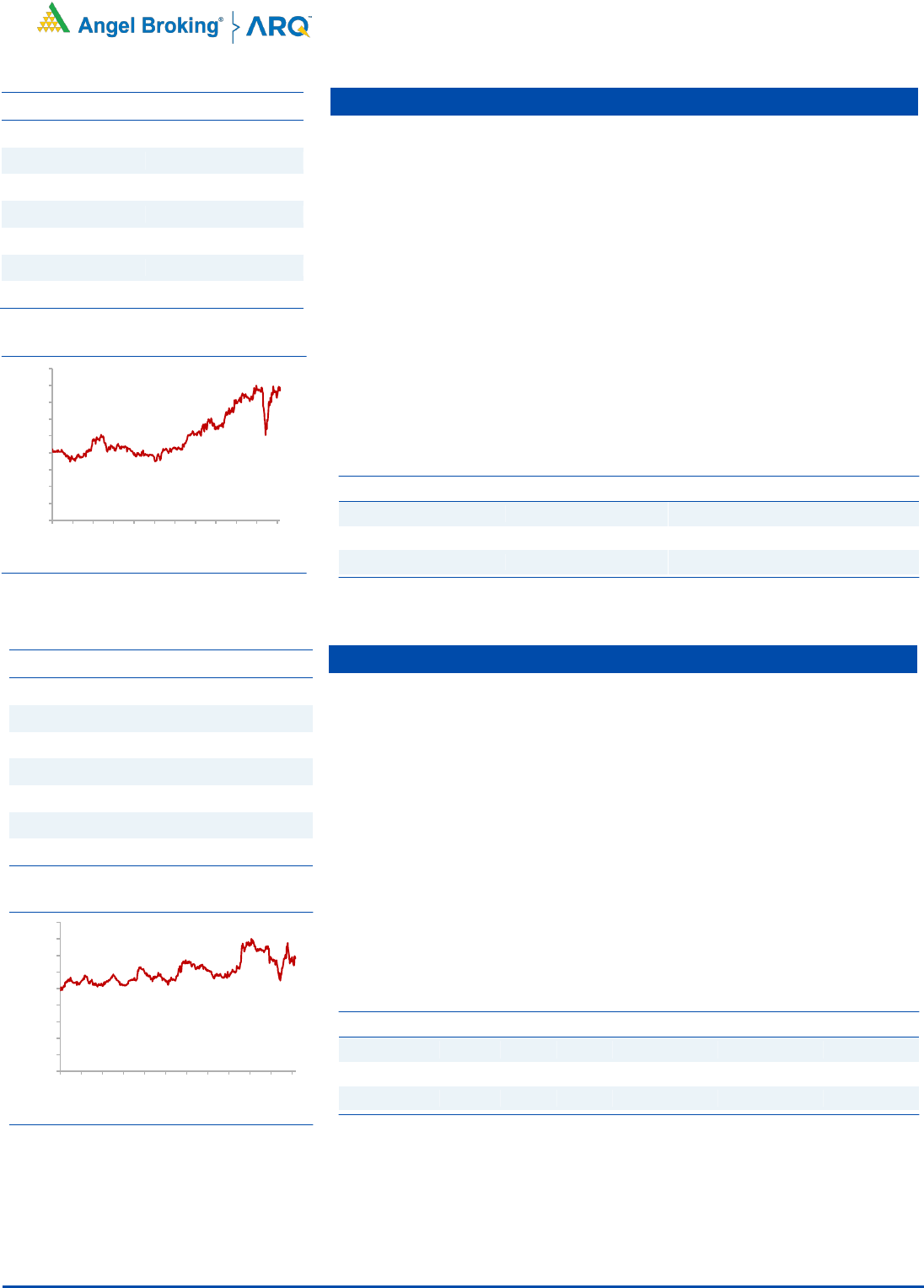

Stock Info

CMP

974

TP

1,284

Upside

31.8%

Sector

Chemicals

Market Cap (` cr)

18,965

Beta

0.8

52 Week High / Low

1,192/662

3 year-Chart

Source: Company, Angel Research

Key Financials

Y/E

Sales

OPM

PAT

EPS

ROE

P/E

P/BV

EV/Sales

March

(` cr)

(%)

(` cr)

(`)

(%)

(x)

(x)

(x)

FY2021E

4822

21.7

538

30.3

16.8

32.2

5.1

3.5

FY2022E

5886

22.2

711

40.1

19.6

24.3

4.4

2.9

Source: Company, Angel Research

Stock Info

CMP

10,032

TP

12,230

Upside

21.9%

Sector

FMCG

Market Cap (` cr)

32,564

Beta

0.4

52 Week High / Low

12,700/8,500

3 year-Chart

Source: Company, Angel Research

Key Financials

Y/E

Sales

OPM

PAT

EPS

ROE

P/E

P/BV

EV/Sales

March

(` cr)

(%)

(` cr)

(`)

(%)

(x)

(x)

(x)

FY2021E

3365

22.2

549.6

169.3

28.0

59.2

15.9

9.4

FY2022E

3803

22.6

637.4

196.4

23.0

51.1

12.0

8.4

Source: Company, Angel Research

-

200

400

600

800

1,000

1,200

May-17

Aug-17

Dec-17

Mar-18

Jun-18

Sep-18

Jan-19

Apr-19

Jul-19

Nov-19

Feb-20

May-20

-

2,000

4,000

6,000

8,000

10,000

12,000

14,000

May-17

Aug-17

Dec-17

Mar-18

Jun-18

Sep-18

Jan-19

Apr-19

Jul-19

Nov-19

Feb-20

May-20

10

Error!

Refer

ence

sourc

Angel Top Picks | June 2020

June 5, 2020

10

Reliance Industries

Reliance Industries Ltd. (RIL) is India’s largest company with dominant

presence in Refining, Petrochemicals, Telecom and Retail businesses.

RIL has built up a dominant telecom business and has already attained market

leader status with 38.3 cr. subscribers at the end of Q4FY20. Telecom

business to witness robust growth over next few years due to tariff hikes and

shift of subscribers from Vodafone Idea to other telecom players.

RIL has also built a very strong retail business which is the largest organized

retailing company in India. We expect the retail business to be a key value

driver for Reliance over the long run though there would be some impact on

business in FY21 due to the Covid-19 outbreak.

Refining and petrochemicals business would be a stable low growth business

for RIL going forward but will be a major cash generator for the company as

there will be negligible capex requirements. The cash flows would be used to

fund expansion into other businesses.

Escorts

Escorts are a prominent tractor player domestically with market share in excess

of 11%. The company’s brand of tractors is particularly strong in the northern

as well as the eastern belt of India.

With rural India relatively less impacted due to Covid-19, record food-grain

procurement by government agencies as well as expectation of normal

monsoon 2020, we expect the tractor industry to outperform the larger

automobile space in FY21E with Escorts a key beneficiary.

Escorts in the recent past has also entered into a strategic partnership with

Kubota Corporation of Japan (one of the global leaders in farm machinery

and implements), which provides further visibility of growth for the company,

going forward.

Stock Info

CMP

1,536

TP

1,748

Upside

13.8%

Sector

Diversified

Market Cap (` cr)

1,038,715

Beta

1.1

52 Week High / Low

1,602/867

3 year-Chart

Source: Company, Angel Research

Key Financials

Y/E

Sales

OPM

PAT

EPS

ROE

P/E

P/BV

EV/Sales

March

(` cr)

(%)

(` cr)

(`)

(%)

(x)

(x)

(x)

FY2021E

3,73,215

13.8

30,272

59.2

6.4

32.2

2.1

5.2

FY2022E

4,57,539

13.3

37,510

47.8

7.8

26.0

2.0

4.3

Source: Company, Angel Research (Above are standalone numbers)

Stock Info

CMP

958

TP

1,150

Upside

20.0%

Sector

Auto

Market Cap (` cr)

11,748

Beta

1.5

52 Week High / Low

986/423

3 year-Chart

Source: Company, Angel Research

Key Financials

Y/E

Sales

OPM

PAT

EPS

ROE

P/E

P/BV

EV/Sales

March

(` cr)

(%)

(` cr)

(`)

(%)

(x)

(x)

(x)

FY2021E

5,880

11

525

42.8

16.8

22.4

3.8

2.1

FY2022E

6,693

11.5

615

50.2

15.6

19.1

3.5

1.9

Source: Company, Angel Research

-

200

400

600

800

1,000

1,200

1,400

1,600

1,800

May-17

Aug-17

Dec-17

Mar-18

Jun-18

Sep-18

Jan-19

Apr-19

Jul-19

Nov-19

Feb-20

May-20

-

200

400

600

800

1,000

1,200

May-17

Aug-17

Dec-17

Mar-18

Jun-18

Sep-18

Jan-19

Apr-19

Jul-19

Nov-19

Feb-20

May-20

11

Error!

Refer

ence

sourc

Angel Top Picks | June 2020

June 5, 2020

11

Hindustan Unilever

HUL is engaged in manufacturing of branded and packaged FMCG products

including soap, detergent, personal care products and processed food. The

company also produces ice creams, cooking oils, fertilizers and hybrid seed

HUL has strong brand recall of its products and HUL has extensive distribution

reach of 7+ million outlets and direct distribution of 3.5+ million retail outlets.

Strong balance sheet along with free cash flow and higher profitability.

Going forward, we expect HUL to report healthy bottom-line growth due to

healthy volume growth on back of strong brand, wide distribution network.

ICICI Bank

The Ability to raise sufficient liquidity at Low cost would be The Key criteria for

banks to navigate the current situation, as asset side inflow would be limited.

ICICI Bank is clearly better positioned in the liability side (in Q4FY20, Deposit

grew 18% yoy and CASA ratio of 45%). Easier and cheaper availability of

deposits gives an advantage to manage ALM given limited inflow from

advance due to moratorium and lower impact on NIM.

Strong liability franchise, Healthy asset mix, higher than 70% provision for bad

asset and More than 80% of incremental lending to high rated corporate

provide comfort.

ICICI Bank is trading (Core Banking Business – 1.1x FY22ABV) at a significant

discount to historical average valuations and offers favourable risk reward

from current levels given global tailwinds.

Stock Info

CMP

2,107

TP

2,364

Upside

12.2%

Sector

FMCG

Market Cap (` cr)

495,120

Beta

0.7

52 Week High / Low

2,614/1,660

3 year-Chart

Source: Company, Angel Research

Key Financials

Y/E

Sales

OPM

PAT

EPS

ROE

P/E

P/BV

EV/Sales

March

(` cr)

(%)

(` cr)

(`)

(%)

(x)

(x)

(x)

FY2021E

40778

24.6

7024

32.5

64.3

63.0

45.6

12.1

FY2022E

44855

24.8

7809

36.2

61.7

56.7

39.4

11.0

Source: Company, Angel Research

Stock Info

CMP

348

TP

410

Upside

17.8%

Sector

Banking

Market Cap (` cr)

225,665

Beta

1.4

52 Week High / Low

552/269

3 year-Chart

Source: Company, Angel Research

Key Financials

Y/E

Op. Inc

NIM

PAT

EPS

ABV

ROA

ROE

P/E

P/ABV

March

(` cr)

(%)

(` cr)

(`)

(`)

(%)

(%)

(x)

(x)

FY2021E

35,063

3.4

8,814

14

176

0.8

7

25

2.0

FY2022E

36,508

3.3

11,909

18

191

1.0

9

19

1.8

Source: Company, Angel Research

-

500

1,000

1,500

2,000

2,500

3,000

May-17

Aug-17

Dec-17

Mar-18

Jun-18

Sep-18

Jan-19

Apr-19

Jul-19

Nov-19

Feb-20

May-20

-

100

200

300

400

500

600

May-17

Aug-17

Dec-17

Mar-18

Jun-18

Sep-18

Jan-19

Apr-19

Jul-19

Nov-19

Feb-20

May-20

12

Error!

Refer

ence

sourc

Angel Top Picks | June 2020

June 5, 2020

12

Axis Bank

The Ability to raise sufficient liquidity at Low cost would be The Key criteria for

banks to navigate the current situation, as asset side inflow would be limited.

Bank is witnessing higher deposit growth in last 2 qtr, which clearly shows

increasing deposit polarisation.

Axis Bank have a healthy asset mix, superior customer profile, liability strength

and capital comfort that is well suited to ride this challenging period.

Axis Bank is trading (Core Banking Business – 1.2x FY22ABV) at a significant

discount to historical average valuations and offers favorable risk reward from

current levels given global tailwinds.

Bajaj Finance

We remain convinced of the strength of BAF’s business model. In this scenario

BAFIN is able to manage raise fund at competitive rate.

27% of AUM has opted under moratorium, However, 68% of this have no

recent bounce history

High Capital (Tier -21.2%) and sufficient liquidity in balance sheet help then to

sail through tough time, better than other NBFC

Considering, above positive and lower valuation than historical average, we

recommend buy on Bajaj finance

Stock Info

CMP

410

TP

500

Upside

21.9%

Sector

Banking

Market Cap (` cr)

119,623

Beta

1.5

52 Week High / Low

826/285

3 year-Chart

Source: Company, Angel Research

Key Financials

Y/E

NII

NIM

PAT

EPS

ABV

ROA

ROE

P/E

P/ABV

March

(`cr)

(%)

(` cr)

(`)

(`)

(%)

(%)

(x)

(x)

FY2021E

26,400

3.1

5,390

19

314

0.6

6

21

1.31

FY2022E

28,698

3.2

6,678

24

335

0.7

7

17

1.22

Source: Company, Angel Research

Stock Info

CMP

2,346

TP

3,000

Upside

27.8%

Sector

NBFC

Market Cap (` cr)

148,256

Beta

1.4

52 Week High / Low

4,923/1,783

3 year-Chart

Source: Company, Angel Research

Key Financials

Y/E

NII

NIM

PAT

EPS

ABV

ROA

ROE

P/E

P/ABV

March

(` cr)

(%)

(`cr)

(`)

(`)

(%)

(%)

(x)

(x)

FY2021E

13,977

9.0

5,182

86

615

3.2

15

28

4.0

FY2022E

15,571

9.5

7,250

121

722

4.2

18

20

3.4

Source: Company, Angel Research

-

100

200

300

400

500

600

700

800

900

May-17

Aug-17

Dec-17

Mar-18

Jun-18

Sep-18

Jan-19

Apr-19

Jul-19

Nov-19

Feb-20

May-20

-

1,000

2,000

3,000

4,000

5,000

6,000

May-17

Aug-17

Dec-17

Mar-18

Jun-18

Sep-18

Jan-19

Apr-19

Jul-19

Nov-19

Feb-20

May-20

13

Error!

Refer

ence

sourc

Angel Top Picks | June 2020

June 5, 2020

13

L&T Infotech

L&T InfoTech (LTI) is one of the fastest growing mid cap IT Company in India.

IT is part of the L&T group and provides services like ADM, Enterprise

solutions, Infrastructure management services etc.

Company has a very strong presence to the BFSI & manufacturing verticals,

which accounts for ~45% and 17.5% of the company’s revenues and are

amongst the least impacted vertical due to the shutdown on account of Covid -

19. The company doesn't have a very large exposure to service oriented

verticals like travel & Tourism which are amongst the worst impacted due to

the Covid – 19 outbreak.

LTI has been growing significantly faster than both mid and large cap peers

have over the past few years on the back of strong deal wins and we expect

the outperformance to continue for the company.

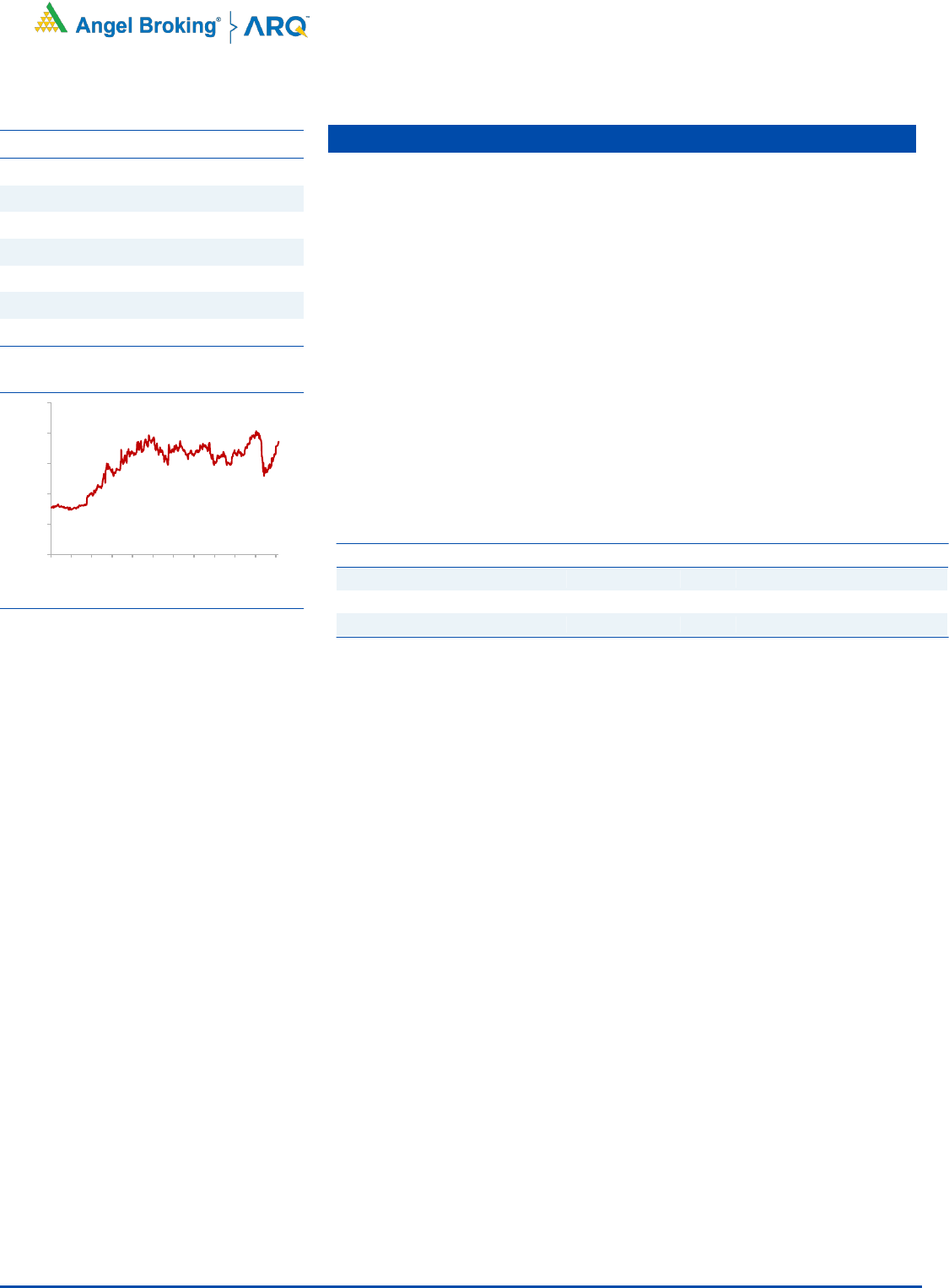

Stock Info

CMP

1,852

TP

2,145

Upside

15.8%

Sector

IT

Market Cap (` cr)

32,255

Beta

0.7

52 Week High / Low

2,050/1207

3 year-Chart

Source: Company, Angel Research

Key Financials

Y/E

Sales

OPM

PAT

EPS

ROE

P/E

P/BV

EV/Sales

March

(` cr)

(%)

(` cr)

(`)

(%)

(x)

(x)

(x)

FY2021E

11,588

18.9

1,611

92.6

0.2

20.0

4.6

2.5

FY2022E

13,085

19.6

1,867

107.3

0.2

17.3

3.9

2.1

Source: Company, Angel Research

-

500

1,000

1,500

2,000

2,500

May-17

Aug-17

Dec-17

Mar-18

Jun-18

Sep-18

Jan-19

Apr-19

Jul-19

Nov-19

Feb-20

May-20

14

Error!

Refer

ence

sourc

Angel Top Picks | June 2020

June 5, 2020

14

Changes in Recommendation

Exhibit 1: Stocks on Hold

Stock name

Hold Date

Hold Price

Jindal Steel

05-10-2019

94

Source: Company, Angel Research

Hold – While we recommend to Hold on to existing positions at current level, we would await

for further data points before recommending any fresh purchases.

Exhibit 2: Stocks bought in last 6-months

Stock Name

Buy Call Date

Buy Price

Hawkins Cookers

09-01-2020

3,591

Asian Paints

11-03-2020

1,864

Bata India

13-03-2020

1,411

Hind. Unilever

30-03-2020

2,141

Avenue Super.

30-03-2020

2,028

Colgate-Palm.

30-03-2020

1,164

Nestle India

30-03-2020

15,110

Dr Lal Pathlabs

01-04-2020

1,384

P & G Hygiene

01-04-2020

10,161

Ipca Labs.

01-04-2020

1,398

Bharti Airtel

01-04-2020

421

Dabur India

16-04-2020

498

L & T Infotech

16-04-2020

1,493

Infosys

16-04-2020

625

Britannia Inds.

16-04-2020

2,832

Alkem Lab

17-04-2020

2,687

Reliance Inds.

17-04-2020

1,189

P I Inds.

24-04-2020

1,506

Galaxy Surfact.

24-04-2020

1,394

Aarti Inds.

24-04-2020

929

Dhanuka Agritech

07-05-2020

438

Hind. Unilever

08-05-2020

2,056

Dr Reddy's Labs

28-05-2020

3,877

H D F C

01-06-2020

1,740

Larsen & Toubro

01-06-2020

951

Escorts

01-06-2020

970

ICICI Bank

01-06-2020

345

Axis Bank

03-06-2020

424

Bajaj Fin.

03-06-2020

2,477

Source: Company, Angel Research

15

Error!

Refer

ence

sourc

Angel Top Picks | June 2020

June 5, 2020

15

Exhibit 3: Stocks sold in last 6-months

Stock Name

Sell Date

Sell Price

Ashok Leyland

05-12-2019

79

Blue Star

06-12-2019

813

HDFC Bank

21-01-2020

1,246

Siyaram Silk

27-01-2020

229

Maruti Suzuki

28-01-2020

7,065

Music Broadcast

29-01-2020

28

GIC Housing Fin

30-01-2020

153

Parag Milk Foods

01-02-2020

137

Bata India

07-02-2020

1,880

Larsen & Toubro

25-02-2020

1,249

Aditya Birla Cap

06-03-2020

75

Dr Lal Pathlabs

09-04-2020

1,462

RBL Bank

15-04-2020

121

Shriram Trans.

15-04-2020

685

KEI Inds.

16-04-2020

279

Safari Inds.

16-04-2020

402

Amber Enterp.

16-04-2020

1,116

UltraTech Cem.

21-04-2020

3,409

Inox Wind

24-04-2020

26

Hind. Unilever

04-05-2020

2,121

ICICI Bank

05-05-2020

341

Dabur India

06-05-2020

450

Asian Paints

07-05-2020

1,610

Hawkins Cookers

22-05-2020

4,235

Bata India

26-05-2020

1,265

GMM Pfaudler

26-05-2020

3,732

Alkem Lab

27-05-2020

2,425

Dhanuka Agritech

27-05-2020

573

Source: Company, Angel Research

16

Error!

Refer

ence

sourc

Angel Top Picks | June 2020

June 5, 2020

16

Research Team Tel: 022 - 39357800 E-mail: [email protected] Website: www.angelbroking.com

DISCLAIMER

Angel Broking Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited, Bombay

Stock Exchange Limited, Metropolitan Stock Exchange Limited, Multi Commodity Exchange of India Ltd and National Commodity &

Derivatives Exchange Ltd It is also registered as a Depository Participant with CDSL and Portfolio Manager and Investment Adviser with

SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Limited is a registered entity with SEBI for Research

Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number INH000000164. Angel or its associates has not

been debarred/ suspended by SEBI or any other regulatory authority for accessing /dealing in securities Market. Angel or its

associates/analyst has not received any compensation / managed or co-managed public offering of securities of the company covered

by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the

contrary view, if any

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Limited has not independently verified all the information contained within this document. Accordingly, we cannot testify,

nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While

Angel Broking Limited endeavors to update on a reasonable basis the information discussed in this material, there may be regulatory,

compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in

connection with the use of this information.

Disclosure of Interest Statement

Top Picks

1. Financial interest of research analyst or Angel or his Associate or his relative

No

2. Ownership of 1% or more of the stock by research analyst or Angel or associates or

relatives

No

3. Served as an officer, director or employee of the company covered under Research

No

4. Broking relationship with company covered under Research

No

Ratings (Based on Expected Returns: Buy (> 15%) Accumulate (5% to 15%) Neutral (-5 to 5%)

Over 12 months investment period) Reduce (-5% to -15%) Sell (< -15%)

Hold (Fresh purchase not recommended)